PPP Fraud Investigation, Man Detained without Bond

The US Attorney’s Office in Central District of California announced Thursday a man alleged of bank fraud related to the Paycheck Protection Scheme (PPP) of the Coronavirus Aid, Relief, and Economic Security /CARES/ Act was detained without bond, pending court hearing on Tuesday.

Andrew Marnell, a 40-year-old resident of Beverly Grove neighborhood in California who fraudulently obtained from insured financial institutions loans to the extent of $9 million and used the proceeds for gambling in Las Vegas and stock market operations is facing a sentence of up to 30 years in prison.

As part of the CARES Act which was designed to provide financial assistance to businesses and individuals suffering from the impact of the virus outbreak and was approved in March, the PPP was introduced to provide funds for businesses to the extent of $349 billion. The funds under the PPP were extended with another $300 billion by Congress in April.

What makes the 2-year maturity loans attractive to businesses is the opportunity for both the principal and the interest, 1% annually, to be forgiven, when a bigger portion of the loan proceeds are spent on payroll costs, interest payments on mortgages, rent and utility payments, within a set period of time.

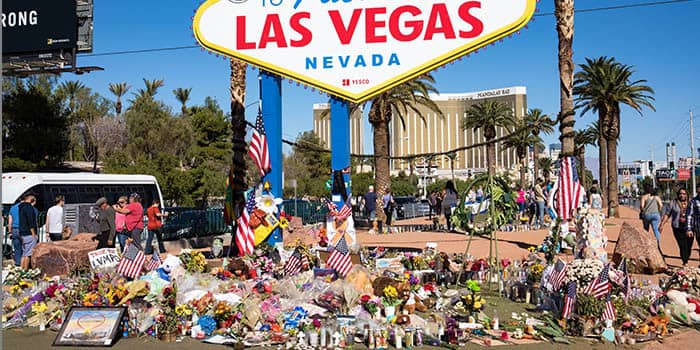

Las Vegas Gambling and Risky Stock Trades

Andrew Marnell was charged with one count of bank fraud as he allegedly obtained millions in PPP loans, on behalf of different companies, as he submitted fraudulent loan applications by providing numerous false and misleading statements regarding the companies’ businesses and payroll records to the financial institutions authorizing the loans.

The complaint alleges Marnell who also used aliases, of submitting fake and altered documents such as federal tax filings and employee payroll records, to mislead banks into releasing loan funds, which were then transferred to his stock trading account and used for high-risk stock market transactions.

Besides the risky stock trades, Andrew Marnell was videotaped by security cameras in the casino of the Bellagio Hotel & Casino in Las Vegas, allegedly spending hundreds of thousands of dollars from the PPP loan proceeds gambling in the Bellagio and other gaming venues.

The PPP helped multiple businesses and supported millions of jobs in Nevada, a recent disclosure by the federal government revealed. The Small Business Administration (SBA) released information in July showing that more than 5,500 businesses in the state took advantage of the financial aid under the program, helping maintain more than 500,000 jobs from industries such as entertainment venues, hospitals and health care organizations, law and news agencies, mining companies and non-for-profit organizations.

Jerome is a welcome new addition to the Gambling News team, bringing years of journalistic experience within the iGaming sector. His interest in the industry begun after he graduated from college where he played in regular local poker tournaments which eventually lead to exposure towards the growing popularity of online poker and casino rooms. Jerome now puts all the knowledge he's accrued to fuel his passion for journalism, providing our team with the latest scoops online.