UK Gambling Commission Imposed A £3M Fine To Mr Green For Systemic Failures

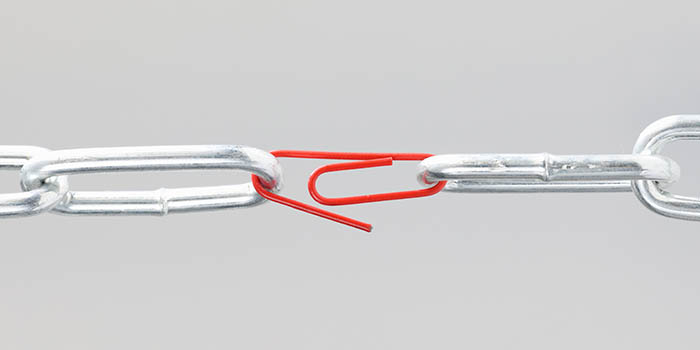

Mr Green, the company that was acquired by William Hill in 2019, has been fined £3 million by the UK Gambling Commission for systemic failings to address measures related to preventing money laundering and instilling a safer gambling environment.

The Malta-based Mr Green /MRG/ is the ninth gambling company to be penalized with a fine by the UK gaming regulator in a series of probes into industry operators that has already generated £20 million from fines since 2018.

Money Laundering Risk Negligence

The Gambling Commission imposed the severe measure to MRG as the probe into its dealing found out transgressions of the terms of its operating license with regards to anti-money laundering practices.

In one of the cases the UKGC highlighted as serious failures by the company, MRG accepted a £176,000 claims payout dated 10 years back as satisfactory proof of source of funds for a deposit of £1 million, while in another the gambling company was satisfied in terms of proof of origin of money with an alleged crypto currency trading account balance, shown as a photo on a laptop screen.

Gambling Addiction Identification

Another occasion the UK GC used to build its case for failure of the company to perform its license obligations was that MRG did not perform a customer check on a client that won £50,000 and then continued betting by losing all the winnings in the process and even depositing and losing thousands more, a failure by the company to possibly help identify a behavior of a gambling addict, with the sensitivity of the matter at the highest since some suicide cases brought the public attention in the UK.

“Consumers in Britain have the right to know that there are checks and balances in place which will help keep them safe and ensure gambling is crime-free – and we will continue to crack down on operators who fail in this area”.

Richard Watson, Executive Director, UK Gambling Commission

The requirement for the gambling operators to check the source of funding of their clients serves two-fold purposes: to make sure there is no risk for money laundering to occur and to set a preventative measure against clients that may lose more than they can afford to lose, possibly an early identification at the source of gambling addictions.

William Hill Rectifies Processes

It is important to note, that all these systemic failing happened before MR Green was bought by the UK-based gambling company William Hill, and consequently, the latter implemented the required processes to fix the issues.

William Hill gets into a lengthy list of operators being fined by the UK Gambling Commission, among Ladbrokes Coral and 888, both being fined for failure to protect vulnerable customers, with some of the bookies even facing their licenses being revoked.

Simon is a freelance writer who specializes in gambling news and has been an author in the poker/casino scene for 10+ years. He brings valuable knowledge to the team and a different perspective, especially as a casual casino player.