Sweden Fines ATG over AML Failures

Responsible for guaranteeing the safety, legality, and trustworthiness of the gaming and gambling industry in Sweden, the Swedish Gaming Authority (Spelinspektionen) is constantly busy supervising operators and issuing penalties to correct bad behavior. Last fall, the regulator started supervising horseracing and betting operator ATG, with a focus on its anti-money laundering policies and the way the operator collected information concerning customers’ identity and their sources of funding.

In this regard, the regulator assessed the internal guidelines and routines used by the operator for managing the risk profiles of its customers. ATG’s measures in relation to in-depth customer awareness were also under review. Now, Spelinspektionen findings have been made public. Here are the highlights of their report.

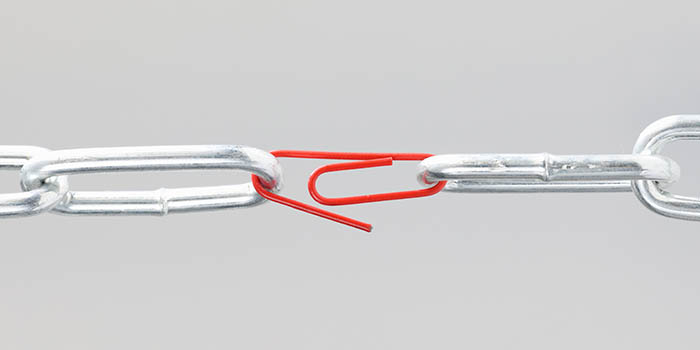

ATG Failed to Assess the Risk of Customers Using It for Money Laundering

According to the official Spelinspektionen’s report, ATG did not fully comply with the legal Know Your Customer requirements. It also failed to take all the necessary measures to evaluate the risk of its business being used for money laundering and terrorist financing purposes. These anti-money laundering failures were deemed serious by the gambling regulator, which is why they attracted a penalty fee of SEK 6 million ($570,000). ATG was also issued a warning by the regulator.

ATG has over four and a half decades of experience in equestrian sports. The operator strives to keep fueling the horseracing industry with its offerings and keep working for a gambling industry “that is better tomorrow than today.” The company called gambling responsibility its “most important sustainability issue.” At the start of 2019, ATG added sports and casino games to its horse racing portfolio. A few months ago, the same operator was issued another fine for a self-exclusion error that prevented gamblers from using the self-exclusion options via their platform for two weeks.

$1M maximum Fine for Failing to Comply with the Money Laundering Act

Swedish operators that fail to comply with the country’s Money Laundering Act by not implementing the necessary measures to combat money laundering and the financing of terrorism through their platform can be fined up to $1 million. The Gambling Act allows even larger penalties that are determined based on operators’ turnover. To prevent any penalty fees and closely follow the regulations, gaming operators need to collect sufficient information that allows them to evaluate and manage all the risks connected to their customers.

The Gaming Authority in Sweden can randomly start to supervise any licensed operator at any given moment. Last week, the regulator banned SG International N.V. from providing its services to Swedish customers for operating without a license.

In other news, Spelinspektionen also fined Kindred Group, which promised to do better.

After finishing her master's in publishing and writing, Melanie began her career as an online editor for a large gaming blog and has now transitioned over towards the iGaming industry. She helps to ensure that our news pieces are written to the highest standard possible under the guidance of senior management.