Canada Gambling Markets Estimated to Reach $4.6bn by 2030

Canada legalized single-game sports wagering Tuesday after passing the Safe and Regulated Sports Betting Act, opening up a huge market for sports betting operators, and stirring speculation which operator is positioned to capitalize and with how much.

Opening Huge Business Potential

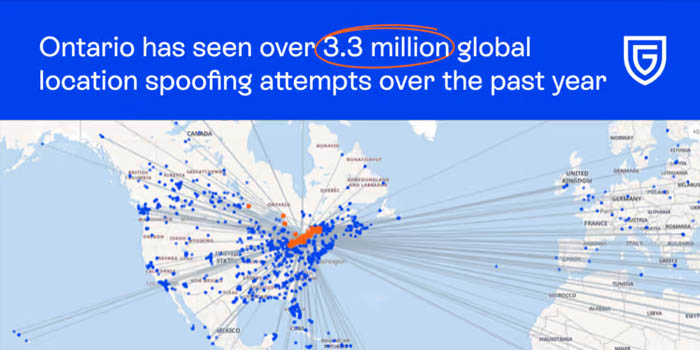

Having signed into law Bill C-218 to legalize single-event sports betting, the legislation is now on its way to Canadian provinces to be implemented locally, with the largest one, Ontario, expected to take action on the matter later this year and open up a market with a size larger than some of the top-performing US sports betting states like New Jersey, Pennsylvania and Illinois.

Chad Beynon, a senior analyst at Macquarie Group, believes the Canadian sports betting market alone could be worth $2.2 billion by 2030. He also estimates another $2.4 billion for iGaming, assuming full legalization of the market, recognizing both estimates as conservative, working on the assumption that every adult Canadian will spend on average $60 per year on sports betting and $75 on online casino games.

According to Beynon, 4 US-based sports betting operators, DraftKings (DKNG), Caesars Entertainment (CZR), BetMGM and Penn National Gaming (PENN), as well as Toronto-based Score Media and Gaming (SCR) are well positioned to profit from the huge potential opening up north of the border.

“In our view, Canada’s population, household income, and sports culture (six NHL teams, one NBA team, one MLB team, and its own football league) make the country an attractive market for US operators. As such, we believe the legalization of Canada’s single-game sports betting market is positive for operators such as SCR, DKNG, PENN, CZR, and MGM.”

Chad Beynon, Managing Director and Senior Analyst, Macquarie Group

A recent statement from DraftKings evaluated the potential of the Canadian gaming market between $5 billion and $8 billion, while BetMGM values it at $7 billion. There is no estimate from another operator, theScore Media and Gaming, which according to analysts is the best-positioned gaming company to take advantage of the single-event betting legalization.

Share Price Projections

The operator of theScore app already experienced a significant increase in share price for the past month while the passage of C-218 was gaining momentum, and if it is capable of capturing 20% of its home market, Beynon believes it would result in a 255% rise in its share price.

A 20% market share in Canada will result in a 28% rise in the stock of Penn National, which also has a 5% holding in theScore Media and Gaming, while for MGM Resorts the analyst sees an 18% rise. For DraftKings, which has an agreement with the NFL in Canada, and Caesars Entertainment, which operates a land-based casino in Ontario, the projected stock growth is 17% each.

Benjamin Chaiken, an analyst at Credit Suisse expects the legalization in Canada to have implications in the US, providing a home market “cash flow engine” for the Score Bet app to expand beyond the 4 states it currently is operational with, projecting a more than doubling for the current operator’s share price.

With 4 years experience as an analyst, Julie—or ‘Jewels’, as we aptly refer to her in the office—is nothing short of a marvel-worthy in her attention to the forex and cryptocurrency space as she quickly became the first pick to co-pilot education to the masses with Mike.