iGaming Leaders Expect Ontario to Lift Private Operator Exclusion From the Gambling Market

With the COVID-19 lockdown weighing down results, the Ontario gambling regulator is considering freeing up the private gambling sector.

New Gambling Regulations Debated as COVID-19 Weighs Down Gambling and the Economy in Ontario

Online gambling firms are anticipating an upshift in regulatory changes by the provincial government of Ontario in response to the projected progression of the pandemic. It’s expected that the current ban on private iGaming operators will be lifted which means they will finally be able to enter the previously restricted legal market of the highly populated Canadian province.

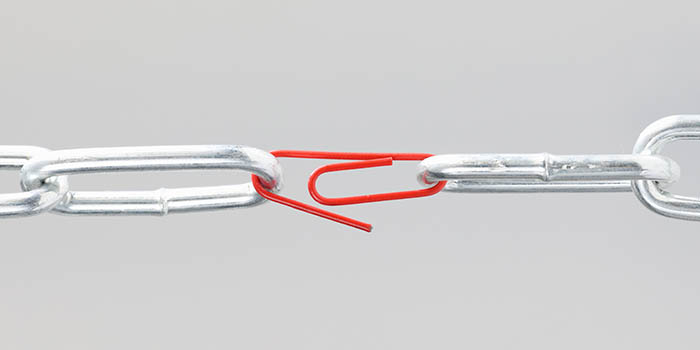

If this is the case, it would inevitably ease the current cash bleed that has been projected to a total of CA$38 billion due to COVID-19. In the current regulatory state, the only legal online gambling operations are run by the government owned Ontario Lottery & Gaming Corp. The total amount spent in online gambling last year by Ontario natives reached CA$500 million, however, a large majority of this was estimated to have funneled into offshore markets.

Danielle Bush, the corporate secretary of the Canadian Gaming Association (CGA) and a partner at Miller Thomson LLP, expects that the tax model to be introduced for legal online gambling will be very reasonable and competitive to that of other global jurisdictions which usually can vary between 15%-25% of gross revenue.

This means that a conservative rate of 20% would generate an extra CA$100 million in annual tax revenue. James Kilsby, an analyst for Vixio Gambling Compliance, predicts that the annual revenue for legalized online gambling will reach CA$547 million after 5 years.

“It will also be a very strong economic driver to the industry to get companies to locate and operate here.”

– Canadian Gaming Association, CEO, Paul Burns

Giving Sports Betting a Leeway and Driving Revenue

Additionally, if the key operator ban is lifted, single-event sports betting activity could be another window of opportunity for boosting tax revenue in the future which financial experts predict would increase the total online gambling revenue to CA$1.47 billion. However, this would require a more extensive change in legislation on the federal level as it’s currently illegal under criminal law in the province.

Besides the monetary benefits, actively pushing to introduce more avenues into gambling could be viewed negatively by the general public regardless if it is done with good intentions for the economy. There is no doubt that the political figures involved will be under heavy scrutiny because gambling addiction is such a polarizing topic, so they will likely need to proceed with calculated precaution.

It’s suspected that the new budget that will be publicly announced on November 5th will be oriented around the response to COVID-19, to which many gambling operators are hopeful for a prioritized focus on paving a way towards a competitive and legal online gambling market.

Although officials have yet to release any timeline details for any of the expected regulatory changes, Scott Blodgett states that “over the coming months, the government will work to develop a new model for online legal gambling to help foster an exciting gambling experience” and that “be determined once further work has been undertaken”.

Mike made his mark on the industry at a young age as a consultant to companies that would grow to become regulators. Now he dedicates his weekdays to his new project a the lead editor of GamblingNews.com, aiming to educate the masses on the latest developments in the gambling circuit.